free cash flow yield private equity

Levered FCF Yield Free Cash Flow to Equity Equity Value Alternatively the levered FCF yield can be calculated as the free cash flow on a per-share basis divided by the current share price. Mainstreet Equity Free Cash Flow Yield.

Fcf Yield Unlevered Vs Levered Formula And Calculator

Read more here will capture the perpetuity value after 2022.

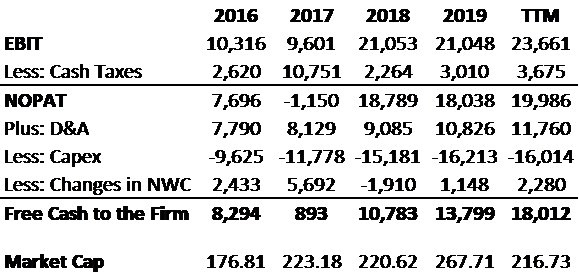

. View Free Cash Flow Yield for MEQTO. Formula 2 FCFF Free cash flow yield calculation from a firms perspective equity holders preferred shareholders and debt holders is as follows. Using the Right Metrics Matters Finding Quality Stocks Using Free Cash Flow COWZ uses free cash flow free cash flow yield and enterprise value to find high-quality value stocks.

This value is the permanent value from there onwards. Free cash flow yield is really just the companys free cash flow divided by its market value. I dont find Net Free Cash Flow used too much possibly because its similar to Free Cash Flow.

Going forward there is no way to be sure that free cash flow yield will continue to provide the best returns. The formula for Terminal value using Free Cash Flow to Equity is FCFF 2022. It had capex spending of 136 million which means CVR generates.

Free Cash Flow Yield Chart. People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to evaluate. In fact there have been market cycles where companies with high free cash flow.

The trailing FCF yield for the SP 500 rose from 11 at the end of 2020 to 16 as of 51921 the earliest date 2021 Q1 data was provided by all SP 500 companies. FCFY Free cash flow to firm FCFF. Unlevered FCFs are generally used by investment bankers while Levered FCF otherwise known as Free Cash Flows to Equity are used more by private equity investors.

Free cash flow to the firm FCFF and free cash flow to equity FCFE are the cash flows available to respectively all of the investors in the company and to common stockholders. This Private Equity Cashflow Model Template is a tool designed to be used at the time of fundraising activities focusing on the private equity cashflow. Whats left is often called free cash flow which is then available to be used perhaps to pay a dividend or expand the businessTo turn this into an equity free cash-flow yield you divide it by.

Free Cash Flow to Equity FCFE Definition. Net Free Cash Flow NFCF Free Cash Flow FCF current portion of long term debt current portion of future dividends 1 year. In the 12 months ending September CVR Energy produced Cash Flow from Operations of 747 million.

View Free Cash Flow Yield for EQC. In corporate finance free cash flow to equity FCFE is a metric of how much cash can be distributed to the equity shareholders of the company as dividends or stock buybacksafter all. Thats the ratio of free cash flow to market cap.

The ratio is calculated. Free Cash Flow is a part of analyzing the strength and health of a company. Cash-on-cash return equity multiple and internal rate of return or IRR.

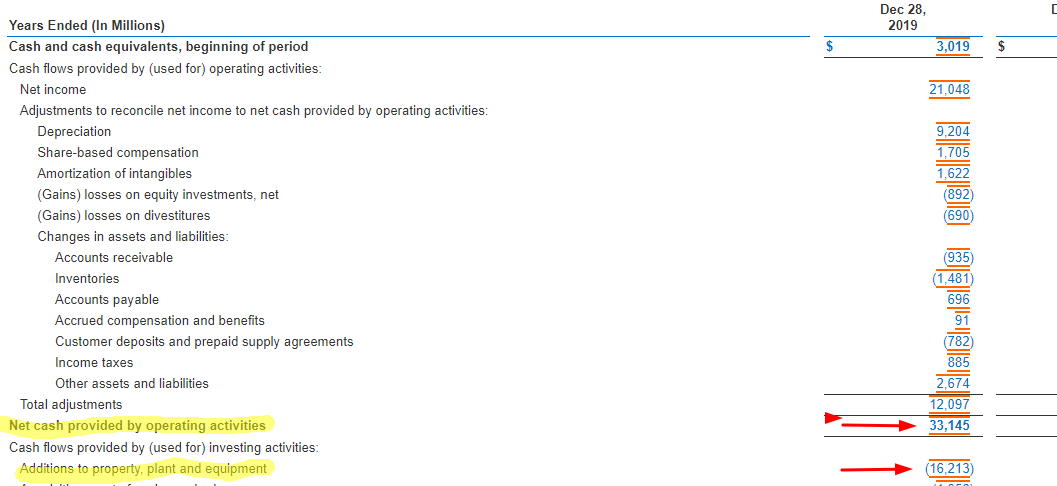

Below is a screenshot of Amazons 2016 annual report and statement of cash flows which can be used to calculate free cash flow to equity for years 2014 2016. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share. Importance of Free Cash Flow.

In our previous post we discussed the meaning and calculation of free cash flow to firm FCFF which is often referred to as unlevered free cash. To break it down free cash flow yield is determined first by using a companys cash flow. Free Cash Flow Yield Chart.

Equity Commonwealth Free Cash Flow Yield. This article examines the practicalities and limitations of three common real estate return metrics. In corporate finance free cash flow to equity FCFE is a metric of how much cash can be distributed to the equity shareholders of the company as dividends or stock buybacksafter all.

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow To Equity Fcfe Levered Fcf Formula And Excel Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Education Metrics Fcf New Constructs

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow Yield Finding Gushing Cash Flow For Future Growth

Free Cash Flow Yield Explained

Free Cash Flow Yield Formula Top Example Fcfy Calculation

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Fcf Yield Unlevered Vs Levered Formula And Calculator

Free Cash Flow From Ebitda Calculation Of Fcff Fcfe From Ebitda

Free Cash Flow Fcf Most Important Metric In Finance Valuation

Fcf Yield Unlevered Vs Levered Formula And Calculator

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

Free Cash Flow Yield The Best Fundamental Indicator

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial